Big change in view for company cars for 2025. The idea behind the new tax regulation is to foster low emission and electric motorisation for company cars and to prepare for the phasing out of internal combustion engines.

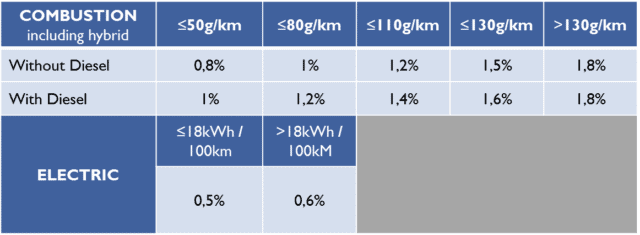

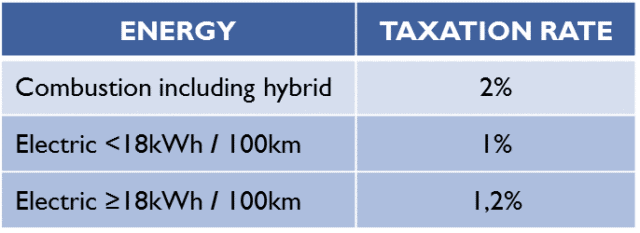

Both first tables show you which tax rate to apply on the vehicle price as new, VAT included, and based on the vehicle’s engine as of 01/01/2023, and then as of 01/01/2025. The CO2 emissions are indicated as per the WLTP standard in force since January 2021.

As of 2025:

Depending on the date of registration of the vehicle and the date of signature of the leasing contract, the taxation regime will vary. The following table will show you the different scenarios and which regime to apply:

*Provided no leasing prolongation has been signed, postponing the leasing’s initial expiry date. Otherwise the prolongation should be considered as a newly signed leasing contract, which will affect the applicable regime, and may result in taxation change for the Employee.

Note that bicycles, e-bikes and scooters that are included in a lease will remain fully tax-free, as was already the case.

Best regards, Bien à vous,